Africa has seen significant economic growth in recent years. After all, it’s the world’s second-fastest-growing region after Asia, with an average growth rate of over 5% in the past ten years. Many countries are aiming for big changes in their economies. However, shared prosperity and poverty still need to be evident despite this progress.

Millions of people across Africa lack access to basic financial services. As a result, the financial inclusion gap in Africa is growing by the day, making it a major problem that holds back individuals and communities alike. Central Bank Digital Currencies (CBDCs) could be a powerful tool to expand financial inclusion. The Kingdom of Kush is at the forefront of harnessing the transformative potential of Central Bank Digital Currencies (CBDCs) to drive financial inclusion and economic prosperity for its people. How and why? In this blog, we look at what a CBDC is and how the Kingdom of Kush is leveraging Central Bank Digital Currencies to empower the underbanked.

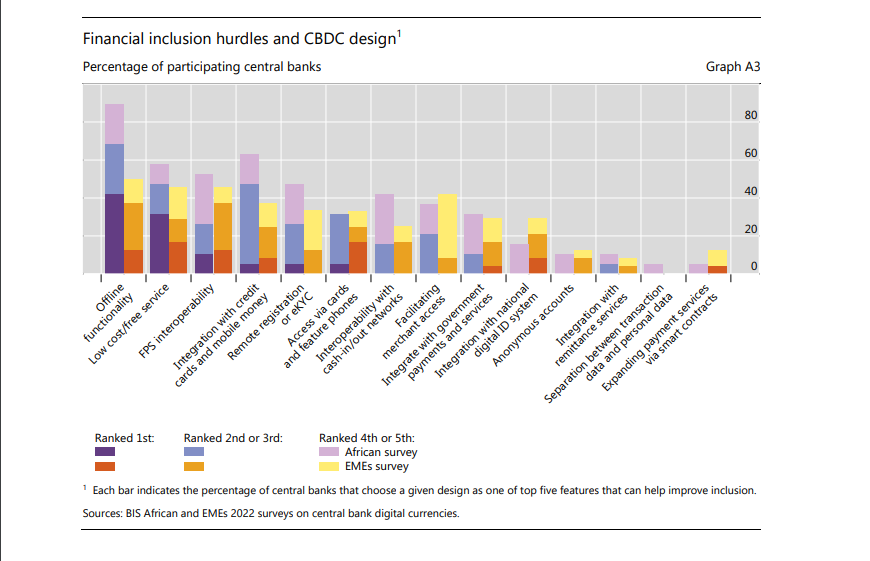

Financial Inclusion Gap in Africa

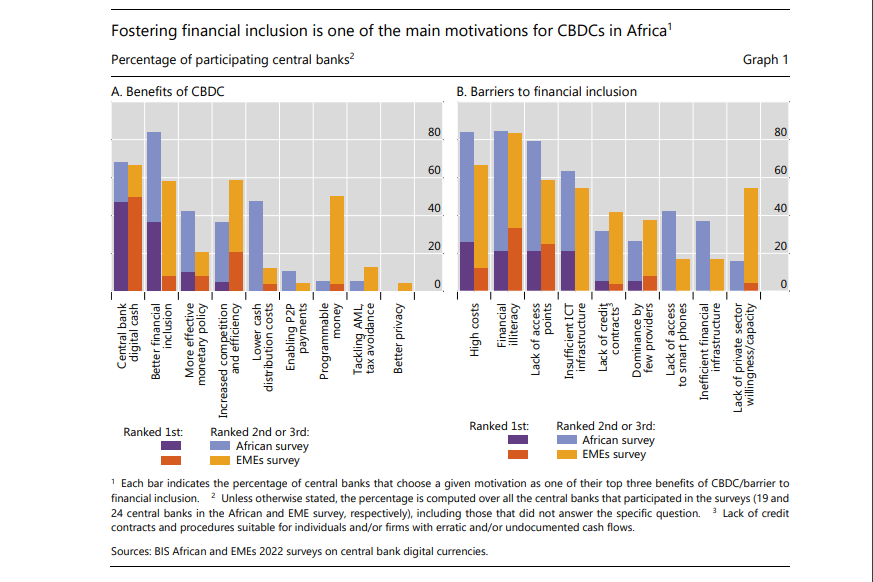

(Source: Central Bank Digital Currencies in Africa by BIS)

Africa faces a significant challenge in getting people access to basic financial services like bank accounts and loans. While many people have some way to manage their money, millions are still left out of the formal financial system.

Formal financial services are offered by places like banks, credit unions, and insurance companies. These are regulated by the government to protect customers. Unfortunately, a much larger gap exists between people who use these formal services and those who don’t, compared to other parts of the world.

This means millions of Africans are missing out on opportunities to save, borrow, and build a better future. Addressing this problem is crucial for Africa’s economic growth and that’s where CBDCs can be a solution.

What is a CBDC?

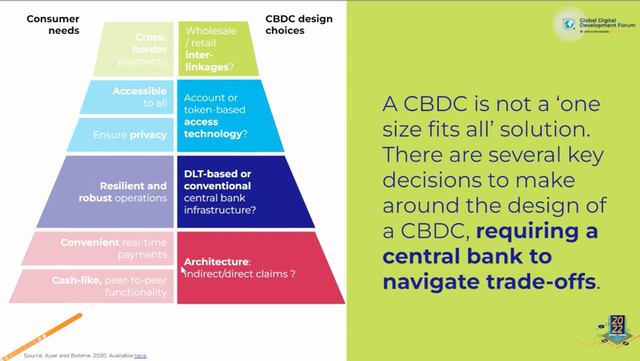

A CBDC is digital money issued by a country’s central bank. It’s like regular money, but digital. Unlike physical money, CBDC exists only as digital records. You would use it with a digital wallet to send money to others. Unlike other digital payments, it can be directly linked to the central bank, making it very secure and reliable.

- CBDCs are different from cryptocurrencies.

- Cryptocurrencies are created by private companies and their value can change rapidly.

- CBDCs are backed by the government, which helps keep their value stable.

(Source: ICT Works)

Designed to be easily accessible to the general public, CBDCs can be utilized for a wide variety of transactions, including retail payments, peer-to-peer transfers, and bill settlements. These digital currencies are intended to be interoperable with existing payment systems. While still in the nascent stages of development and implementation globally, CBDCs hold significant potential, particularly for developing economies.

By offering improved financial inclusion, enhancing financial stability, increasing transparency, and streamlining efficiency, CBDCs can contribute substantially to the economic growth and development of Africa.

How Can CBDCs Help the Underbanked?

(Source: Central Bank Digital Currencies in Africa by BIS)

Many people in Africa don’t have bank accounts. CBDCs can help by:

- Making money easier to send and receive: People can send money to family and friends quickly and cheaply, without needing a bank account.

- Providing access to financial services: CBDCs can be used to pay bills, buy things, and even save money, just like regular cash.

- Protecting people from fraud: CBDCs are secure, making it harder for people to lose money to scams.

- Helping businesses grow: Businesses can use CBDCs to pay workers and suppliers more easily.

CBDCs aren’t just good for the underbanked. How well they work depends on how they’re designed and used in each country.

They can help everyone by:

- Improving the economy: More people using money means more economic activity.

- Helping the government understand the economy better: Data from CBDC use can help governments make better decisions.

- Building trust: Make people feel safer about using digital money.

- Lowering costs: Make financial services more affordable for everyone.

- Encouraging more businesses to go digital: Help shops and companies accept digital payments.

- Helping people with little tech knowledge: Make sure everyone can use CBDCs, even if they need to improve with technology.

- Working in places without good internet: Allow people in remote areas to use digital money.

By doing these things, CBDCs can help more people access and use financial services.

Why Central Banks in Africa Are Considering CBDCs

(Source: Fuje, H.; Quayyum, S.; and Ouattara, F. (2022))

Africa’s financial landscape is ripe for innovation. While challenges persist in financial inclusion, the continent has demonstrated a capacity for financial product innovation. Central Bank Digital Currencies (CBDCs) represent the next frontier in this evolution.

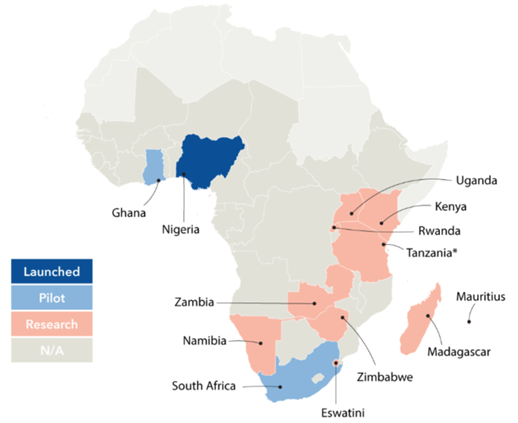

At least ten African nations, including Nigeria and Ghana, are actively exploring or implementing CBDCs. Take, for instance, Nigeria’s e-Naira: Nigeria pioneered the adoption of Central Bank Digital Currencies (CBDCs) in Africa with the launch of the eNaira in 2021. Initial statistics indicated a promising start, with hundreds of thousands of consumer and merchant wallets registered within the first month. However, challenges in onboarding users, particularly those without existing bank accounts or email addresses, have hindered widespread adoption. This highlights the critical importance of careful planning and execution when implementing CBDCs.

This surge in interest in CBDCs is driven by several key factors:

- Expanding Financial Inclusion: CBDCs can democratize access to financial services, bypassing traditional banking infrastructure and reaching underserved populations.

- Preserving Monetary Sovereignty: The rise of private digital currencies and the potential dominance of foreign CBDCs necessitates a local digital currency to safeguard monetary policy independence.

- Enhancing Payment System Resilience: CBDCs can provide a robust, domestically controlled payment system, reducing reliance on foreign-owned infrastructure.

- Mitigating Financial Stability Risks: By introducing a public digital currency, central banks can counter the potential risks posed by private cryptocurrencies to the financial system.

- Facilitating Digital Economy Participation: CBDCs can serve as the foundation for a thriving digital economy, enabling efficient transactions and economic growth.

By addressing these challenges and capitalizing on opportunities, African nations can leverage CBDCs to shape the future of their financial systems and drive economic development.

How the Kingdom of Kush is Leveraging Central Bank Digital Currencies

By offering secure, accessible, and efficient digital money directly issued by the central bank, the Kingdom’s CBDC initiative aims to make it easier for people to send, receive, and manage their finances, even without traditional bank accounts. This can unlock a wealth of economic opportunities for individuals and businesses alike, fueling the Kingdom’s digital transformation.

Moreover, the Kingdom’s CBDC ecosystem will lay the foundation for a thriving FinTech innovation hub, as entrepreneurs and developers leverage this digital currency infrastructure to create cutting-edge financial solutions tailored to local needs. From streamlining cross-border payments to enabling inclusive savings and lending platforms, the Kingdom’s CBDC-powered FinTech ecosystem will redefine financial services and drive sustainable economic growth.

By preserving monetary sovereignty, enhancing payment system resilience, and mitigating the risks posed by private digital currencies, the Kingdom’s CBDC strategy positions it as a leader in the global digital currency landscape. As the African continent continues to embrace the digital revolution, the Kingdom of Kush stands ready to showcase how innovative CBDC implementation can empower the underbanked and unlock a future of shared prosperity.

Conclusion

CBDCs have the potential to transform lives in Africa. By giving more people access to money and financial services, we can create a more inclusive and prosperous future. Governments, banks, and businesses need to work together to make this happen. By working together, we can harness the power of digital currency to build a more prosperous Africa.

Learn more about how the Kingdom of Kush is driving financial inclusion and economic growth through innovative solutions.